| Sinclairvoyance |

A YEAR AGO, in Sinclairvoyance, we reported on the bitter price-cutting war which had all but destroyed the home computer market in the States. Texas Instruments, Mattel Electronics and Timex withdrew entirely from the fray, counting enormous losses, while Atari carried on fighting, nursing its severely charred fingers. Commodore emerged as the victor, and went on to consolidate its position.

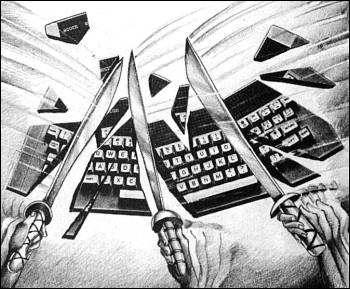

We predicted then that this would happen in Britain, and during the last three months the knives have been out with a vengeance.

Strangely enough, it was veteran campaigner Atari which declared war by reducing the price of its 800XL micro to £129.99, the second cut in three months, and just in time for Christmas. That move reflected the marketing aggression of Atari's new boss Jack Tramiel, ex-chairman of Commodore, and it is Atari's avowed intention to be the "number one home computer manufacturer by October 1985".

The cut did little to help Atari sales over Christmas, and any hopes for a killing in the new year were dashed when Sinclair announced a price cut of £50 on the Spectrum Plus. Beleaguered Acorn, already a loser after a £4.5 million autumn advertising drive failed to sell anything like the expected 300,000 machines, desperately tried to fight back with a £70 reduction on the Electron.

Commodore too had a difficult Christmas, and laid off 114 workers at its Corby plant. In the States the season was disastrous, with Commodore profits down from $50 million in the last quarter of 1983 to only $3.2 million in the same period last year. The company reacted by 'temporarily' axing 540 jobs and dropping the C64 price to $150. It now looks set to slog it out with Atari, both companies pinning their hopes on new 68000 based machines to be launched this year.

Commodore UK has followed its rivals by cutting a massive £150 on the Plus/4 micro, a peculiar move as the Commodore 64 appears over-priced in comparison. At the time of writing, there were no plans either to reduce the price of the unsuccessful C16, still priced at £130.

While the big boys go for each other's throats, the smaller companies are finding it difficult simply staying alive. Casualties of the depressed state of the market already include R & R Electronics, Front Runner, Cambridge Computing, Fuller, Nordic, Stack Computer Systems and Currah. One-time Sinclair distributor Prism has called in the receivers, as has Oric. Among the magazines which have fallen by the wayside are Big K and Personal Computer Games.

Significant as those casualties are, they pale when compared to the reverberations heard when the giant Acorn tottered and fell.

Acorn was floated on the unlisted securities market over 18 months ago when the company was worth £135 million. At their peak Acorn shares touched 193p. The Electron price cuts caused a crisis of confidence which brought share prices falling to such an extent that trading was suspended at 28p a share. That followed the sacking of Acorn's bankers Lazard Brothers and the resignation of brokers Cazenove.

Fortunately for Acorn co-founders Hermann Hauser and Chris Curry, the seventh cavalry arrived in the shape of Olivetti, the Italian electronics combine which claims 15 percent of the European personal computer market. Olivetti bought 49.3 percent of Acorn at only eight pence a share. A reorganisation of the company is to follow, together with 90 redundancies in addition to the 30 announced at the beginning of February.

While Acorn looks forward to "addressing the challenges and opportunities which now lie ahead", as Curry judiciously puts it, the industry is still picking up the pieces. Among those affected is Sinclair Research, which yet again has postponed its stock market flotation, planned for March. The decision was made because of the general belief in the City that the home computer boom is over, following the Acorn crisis.

That belief has been fueled by the national press, which has pounced on the Acorn, Oric and Prism difficulties with glee. 'Home computer boom is over', screeched the Sunday Times. Sales of toy computers have peaked', pompously droned the Daily Telegraph.

Stockbrokers Wood, Mackensie & Co are more optimistic, predicting that "good growth in disposable incomes over the next two years should provide the basis for spending on home computers to continue to rise sharply.

Who will be the winners? It is difficult to see how Acorn, even with Olivetti's backing, can recover lost ground, while Commodore and Atari are chancing it with their proposed 68000 machines. The Enterprise might well have arrived too late, and MSX too early. Amstrad alone looks set to do well. Sinclair, as Wood, Mackensie & Co state, "should remain at the forefront" provided the QL makes 'a bigger impact' and quality control is 'drastically improved'.

This year will be the most exciting, and the most brutal, the fledgling home micro industry has yet experienced. Look out for sparks.

Bill Scolding